How We Rebalance Smart Cash.

Apr 22, 2024

As you know, the goal of Titan Smart Cash is to maximize your after-tax yield on cash at any given moment in time.

We conduct daily rate scans across our investable universe of cash alternatives in an effort to ensure that your cash is working as hard as possible. In the event that a higher rate is found, we have the ability to rebalance you into that higher yielding offering to ensure you're receiving the highest rate possible.

As yields have evolved, a few savvy clients have reached out wondering "Why haven’t I been rebalanced into the highest yielding option?"

We’re all about transparency at Titan, so let’s dive into the technical details to explain 'the why'.

Our Smart Cash algorithm is built to systematically maximize your after-tax yield on cash. Our Smart Cash software:

1.) Estimates your tax rate based on your latest personal tax details

2.) Calculates the after-tax yield that you would earn across available money market mutual funds and Titan Cash Reserve

3.) Identifies which fund has the highest anticipated annual after-tax yield for you - we’ll call this “best yield”

3a. If the “best yield” is greater than .05% the annual yield of the fund you’re currently in, then we switch to the higher yielding option. It's important to note: a rebalance like this results in up to 3 business days out of the market given the settlement times of money market funds

3b. If the "best yield" does not satisfy 3a, Titan will not conduct a rebalance and you'll stay in the current fund

Part 3a. is the culprit of why you may not be invested in the highest yielding fund you currently see on Titan, and we feel good about that.

Let’s talk through why.

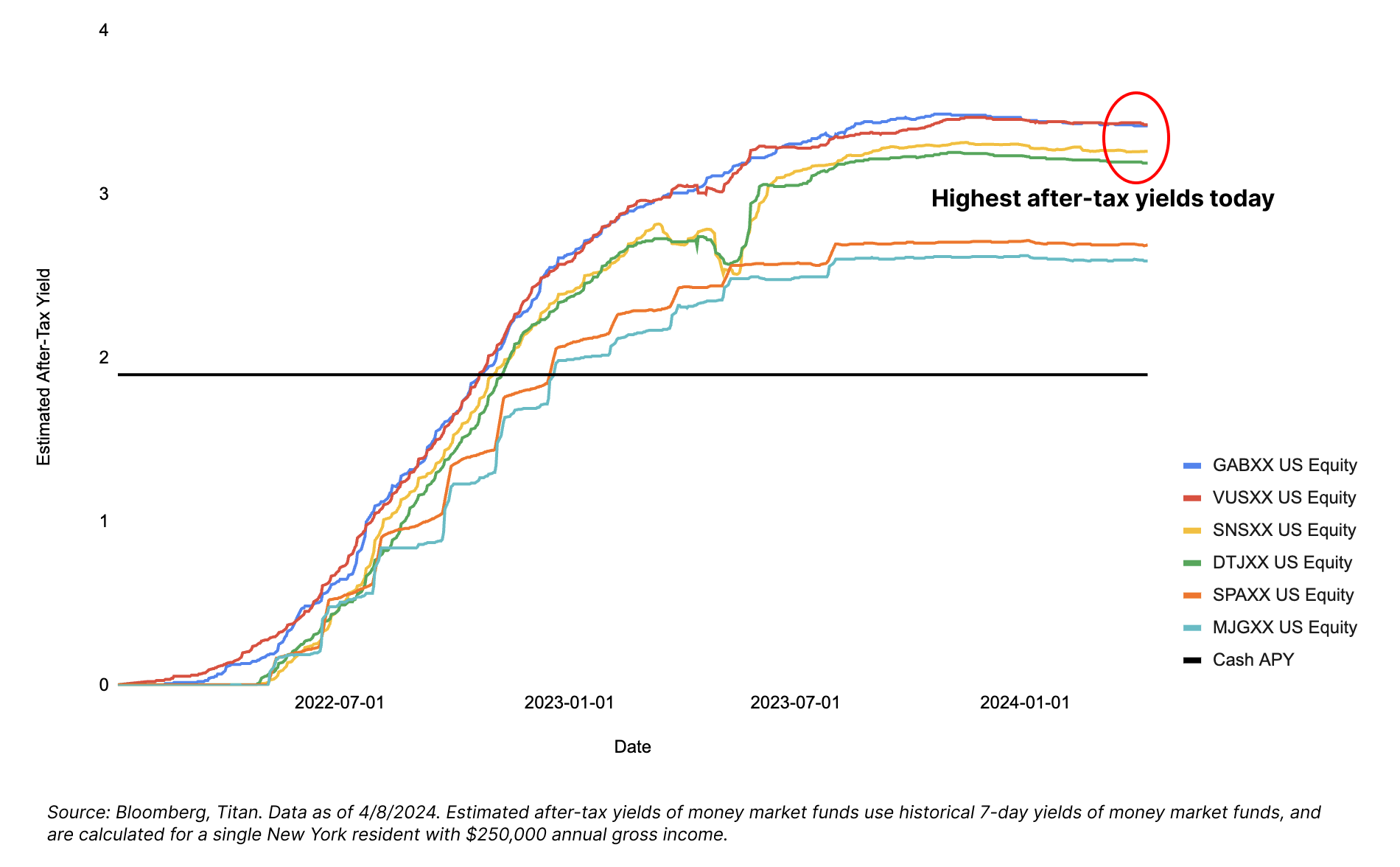

Estimated After-Tax Yields of Money Market Funds.

So, where are we today?

The after-tax yields of GABXX and VUSXX are extremely close - in fact, they are within .05% of each other.

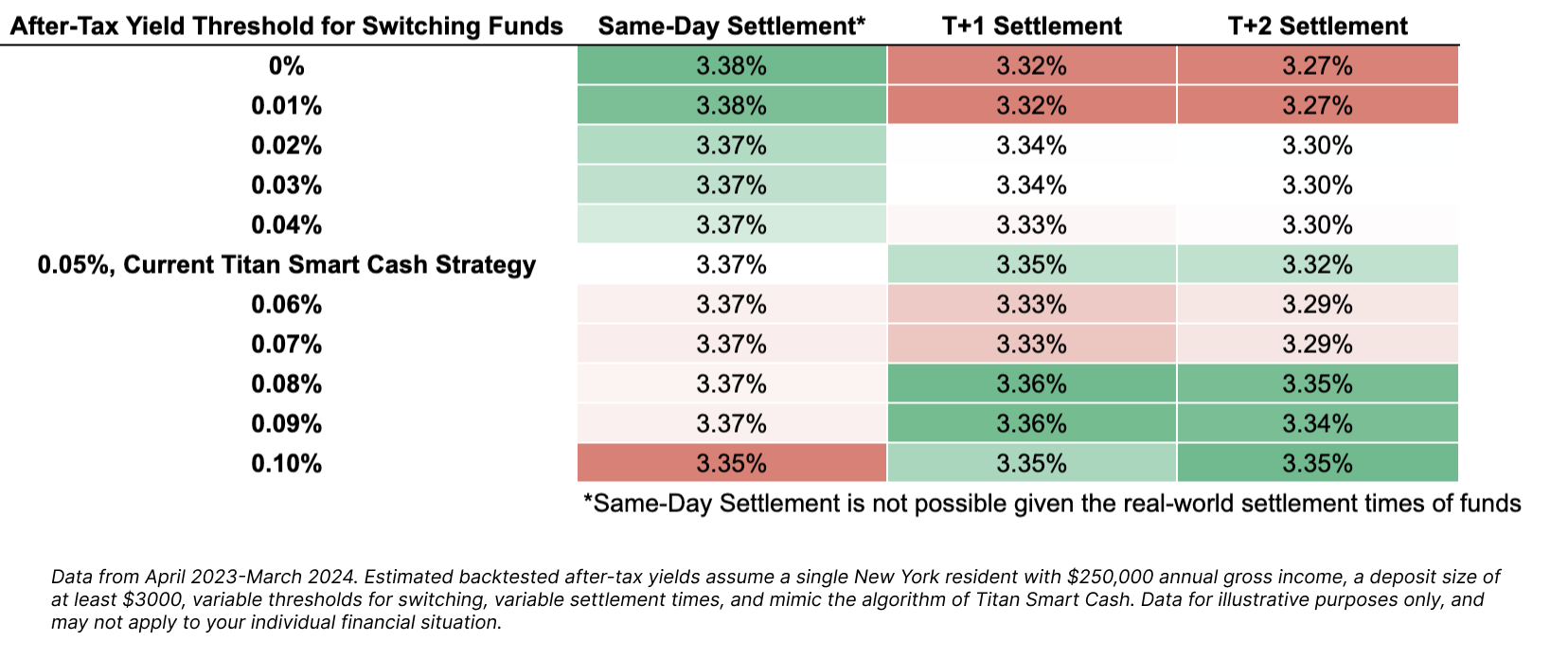

What would happen if we lowered our threshold for switching, so that we’d more tactically rebalance clients into the highest yielding fund more often, rather than waiting to hit a .05% threshold?

With backtesting, we can see see how performance over the past year would have been impacted by the average after-tax yields of Titan Smart Cash if we lowered this threshold.

In a world where you could instantly switch funds with no settlement time, it makes sense to have no threshold for switching funds.

But when accounting for real-world constraints, even just a one-day lag (i.e. T+1) incurs an opportunity cost of sitting out of the market for too long. We feel that our switching threshold of .05% strikes a nice balance, allowing us to tactically switch in the current rate environment, while also considering the opportunity costs incurred by settlement times.

As clients have pointed out, there must be some amount of time that could pass in which it would have been better to be in the absolute highest yielding fund, even within .05% right?

That’s true – let’s dig into it:

Imagine that you are invested in Vanguard’s VUSXX with all of the assumptions we’ve used above.

As of 4/8/24, this is the second highest yielding fund in Titan Smart Cash on an after-tax basis, and you haven’t been “switched” because the highest yielding fund, GABXX, is only higher by ~0.01%.

VUSXX Estimated After-Tax Yield: 3.42%

GABXX Estimated After-Tax Yield: 3.43%

Assume that you did switch funds, leaving you out of the market for a relatively speedy 1 business day (in practice, settlement times may be longer).

If after-tax yields stay exactly the same going forward, it would take more than 500 trading days to make up for the yield forfeited from even just one day out of the market.

This is because the difference between earning ~3.4% yield vs. earning 0% while out of the market is much larger than the difference between the two highest yielding funds. That’s why we feel it’s important to incorporate a small .05% threshold to keep you earning yield.

We take our client feedback and questions to heart, and are constantly exploring new improvements to all of our offerings.

Most importantly, we want to make sure that everything we offer is not just a good investment in theory, but in practice.

This is just one example of some of the work we are doing behind the scenes as we help find our best after-tax yield for you.

If you have any questions or feedback, feel free to reply directly to this email - we love hearing from clients and are happy to help any way we can.

- Your Titan Team

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.