Netflix stumbles on subscriber miss

Apr 21, 2021

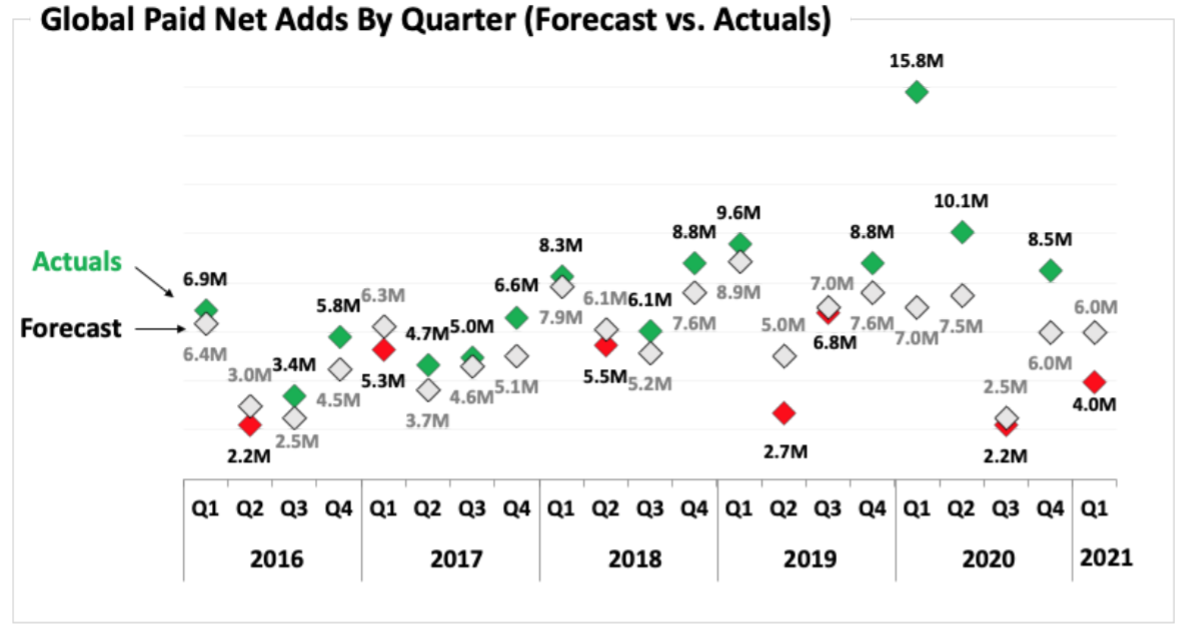

On Wednesday morning, Netflix stock dropped -7% after reporting Q1 subscriber growth numbers that came in significantly below forecasts (4M vs. an estimated 6M).

While revenue, margins, and in particular, cash flows all came in very strong, around earnings dates Netflix trades almost instinctively on subscriber growth expectations.

This is both because of that metric's position at the top of Netflix's growth algorithm, as well as the historical dearth of other meaningful cash flow and profit metrics on which to evaluate Netflix's performance.

While some analysts will be quick to interpret the subscriber miss primarily as a signpost of the end of the pandemic period growth, we believe it's worth noting that it's likely just as much a reflection of the simple difficulty of forecasting subscriber metrics over a historically unique period.

In fact, over the past 5 pandemic quarters, Netflix has consistently over and undershot all of its subscriber forecasts, with an average deviation of +2M (and a range of deviations spanning from -2M to +9M).

Netting all of that out, from the beginning of 2020 through next quarter's forecasts, Netflix is on track to surpass its total subscriber projections by +8M on net.

We expect quarterly subscriber metrics will continue to be volatile over the coming quarters with pullforwards giving way to givebacks that on net we expect will land on the positive side for Netflix (as the data currently suggests).

But in the bigger picture, what we believe is more important is that Netflix's user experience flywheel simply remains strong and turning. This is something we were pleased to see indicated by the other key metrics Netflix reported on.

For example, in Q1 Netflix reported seeing user engagement increase year-over-year (vs. the tough Q1 2020 compare) while churn simultaneously decreased despite a trifecta of seemingly major headwinds: increased reopenings, price hikes, and clampdowns on password sharing.

We believe that is a remarkable feat, especially considering those outcomes were achieved despite a slowdown in content spending, which in our view is indicative of the durability and long tail nature of Netflix's content investments.

Stepping back, as cash flows and capital allocation increasing becomes part of Netflix's earnings story, we believe investors will increasingly broaden their focus beyond quarterly subscriber growth metrics.

Netflix is maintaining its guidance for hitting cash flow breakeven this year, and in Q1 posted free cash flows that more than 3x'd analyst estimates.

While this was of course partially a result of the lower content spending environment (which will re-accelerate in the back half of this year), we believe those results are a powerful indication of what Netflix's end state economics could look like.

We'll continue to closely monitor Netflix's subscriber growth progression as it navigates the transition into an increasingly re-opened world.

In the meantime, we're pleased to see management is similarly prepared to capitalize on any remaining air pockets afforded to it by the market's focus on quarterly net adds with its newly authorized $5 billion share buyback authorization.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.