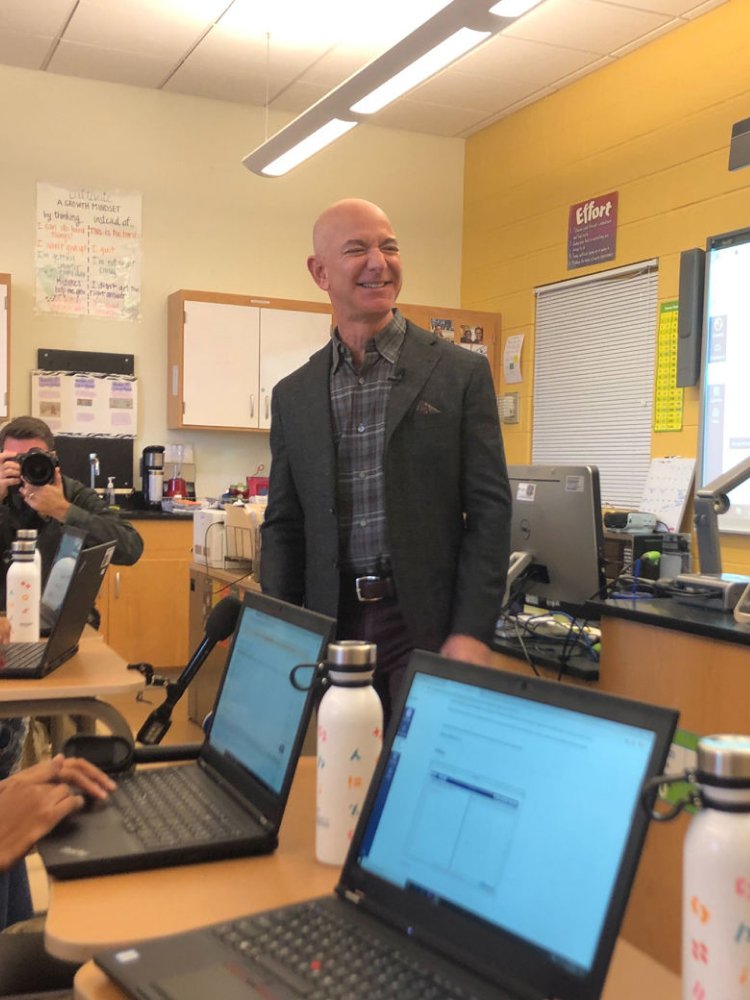

Jeff Bezos hands over CEO reins

Feb 3, 2021

On Tuesday after hours, both Amazon and Google competed for investor attention after posting blowout quarterly results and unveiling big cloud-related announcements.

Google quickly rose +7% as recovering ad spend and strength in YouTube propelled the company above revenue and profit estimates by an incredible +8% and +41%, respectively.

The big story was on the Cloud side, with the company breaking out the segment's P&L for the first time, setting investors up for more refined sum-of-the-parts valuations, on which the company should screen screamingly cheap.

The new Cloud disclosures also painted the picture of a cloud business that was scaling rapidly (with order backlog up nearly +60% vs. the prior quarter) and starting to see operating leverage, with losses staying flat year over year despite the massive topline growth.

However, all of this paled in comparison to Amazon's big reveal - that storied CEO Jeff Bezos would be stepping into an executive chairman role and passing off CEO responsibilities to "the father of AWS," Andy Jassy.

To some extent, this shouldn't be a huge shock, as Jeff has likely mostly occupied the role of an executive chair for quite some time now, focusing on high level strategic decisions as opposed to more day-to-day functions around operations and execution.

He's also clearly telegraphed his strong interest in passion projects beyond Amazon for quite some time now, projects that span from philanthropy to climate change to space exploration.

However, as one of the most visionary and respected executives of our times, the transition is still a dramatic change for investors to grapple with, which was reflected in the stock's reaction.

Amazon's Q4 results were decidedly stellar. At its mammoth scale, the company somehow managed to top profit expectations by nearly 100% and boosted its Q1 sales outlook +8% above analyst estimates.

But despite these blowout results, the company's stock price remained relatively unchanged, a reaction that we view as a testament to the degree of respect with which investors view Bezos's leadership.

We're optimistic on the transition to Andy Jassy, someone who despite his low public profile was almost single-handedly responsible for the creation of AWS (and by implication, the whole cloud computing market) as we know it today.

In the meantime, for long-term investors, the key performance indicator to track for Amazon will likely remain the same: how closely the company continues to true to its forever "Day 1" mentality.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.