Opportunities in Plain Sight

Oct 27, 2020

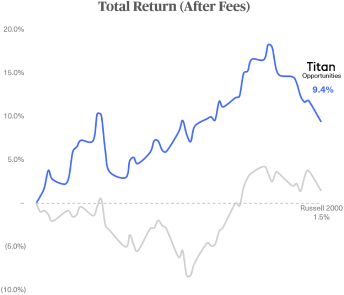

In August, we launched Opportunities, focused on owning outstanding under-the-radar companies for our clients. Since then, the Opportunities portfolio has risen +9% vs. the Russell 2000 Index up +1%.

We've received many questions from clients on how to think about Opportunities, and will address the top questions we've received below.

In short: we believe Opportunities serves as an excellent complement to the Flagship portfolio, and displays many of the same attractive risk/reward dynamics that should power high returns for years to come.

Attached is the full memo, along with a 2-minute video summary from our Chief Investment Officer.

Q: What's driving the Opportunities outperformance?

A: Two things. Owning fundamentally strong companies before the crowd catches on and a high slugging percentage across the portfolio.

We believe our Opportunities holdings are simply great businesses with secular tailwinds at their backs (e.g., e-commerce, fintech, SaaS). They tend to go overlooked by institutional investors, many of whom can't even own these stocks because their funds are too big.

As these companies grow in market value, they tend to enter the radars of large investors who can finally own them. We've seen this dynamic play out for many Opportunities companies in recent months.

Represents return for Titan Opportunities (after fees) from inception through 10/26/2020 for a client with an aggressive risk profile. See full disclosures.

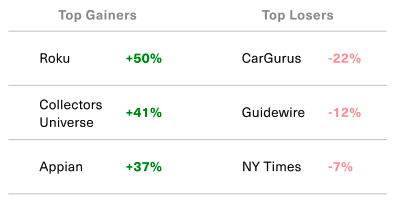

The second key contributor is a high "slugging percentage" - or put differently, the dynamic of having winners that win a lot more than losers lose.

So far, 75% of the Opportunities portfolio has increased in market value since the strategy's inception, with the median gainer rising by +17%. By contrast, the median laggard in the portfolio has lost only -7% to date.

While we expect the magnitude of both of these dynamics will fluctuate with short-term price movements, in the long run we believe both will remain sustainable drivers of our outperformance versus the broader market.

Q: Is Opportunities a risky strategy?

A: In our view, no. Don’t confuse “volatility” for “risk.” Similar to Flagship, we see low risk of permanent capital loss in Opportunities.

Most people have the wrong definition of risk. You need distinguish between (1) volatility and (2) true risk.

(1) Volatility is the daily turbulence in stocks' prices. We expect the daily volatility in Opportunities to be greater than what we've seen in Flagship given these are smaller, less liquid equities. Hence the opportunity (pun intended).

(2) True risk is the chance of permanent capital loss. Our Opportunities companies are among the best positioned in the small/mid cap universe in terms of competitive advantages, growth runways, and unit economics. We see low odds that the plane goes down, so to speak, for any of these holdings.

(1) + (2) = We expect slightly greater daily ups and downs for Opportunities than we see with Flagship, but similarly low chances of long-term capital loss.

Q: How much should I invest in Opportunities?

A: This ultimately depends on your investment goals and appetite for volatility.

Are you new to investing or uncomfortable with short-term swings in your stocks? If so, the personalized recommendations in the app are a great start.

Are you less phased by short-term price fluctuations? If so, you can meaningfully dial up your exposure to Opportunities. Some clients choose 50/50 mixes of Opportunities/Flagship; others go even higher.

If you're currently underinvested in Opportunities and have investable assets sitting in cash, we'd recommend deploying those assets into Opportunities until you've met your target allocation. This will allow you to increase your exposure to Opportunities without incurring tax consequences from selling other assets.

After the recent 10%+ correction in the Opportunities portfolio in particular, we believe now is an attractive time for clients to be buying more of the high-quality franchises in this basket. Same goes for Flagship, per our last memo.

We'll continue to monitor the performance of both strategies as we move forward and will keep you apprised of any updates to our recommendations.

Let us know if you have any questions, Titan Research

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.