Fastly's guidance update: Twilio 2.0?

Oct 15, 2020

On Thursday, Fastly fell 27% after trimming its guidance for Q3 revenue by 5%. The drop brought the stock to levels it last saw two weeks ago.

The guidance reduction was largely attributable to lower than expected revenues from TikTok, currently Fastly's largest customer (representing ~12% of revenues, with the US business contributing to roughly half of that).

While some might scratch their heads at a seeing 27% pullback on a 5% guidance reduction, we would flag that this pullback follows the stock's steep ~40% rally over the past two weeks, so is arguably a natural re-basing of expectations after a run-up that can only be described as furious.

But more importantly, we don't see Fastly's long-term outlook as having materially changed following the guidance reduction, and view the current pullback as an attractive dislocation for long-term holders to increase their exposure.

Stepping back, the current setup in Fastly reminds us tremendously of Twilio back in early 2017, when the company experienced outsized volatility due to its elevated exposure to a large customer (Uber).

Twilio as you may know is one of Titan's best performing holdings to date, and like Fastly, is a developer-led software infrastructure business that prices its products based on customer usage (in other words: non-fixed pricing).

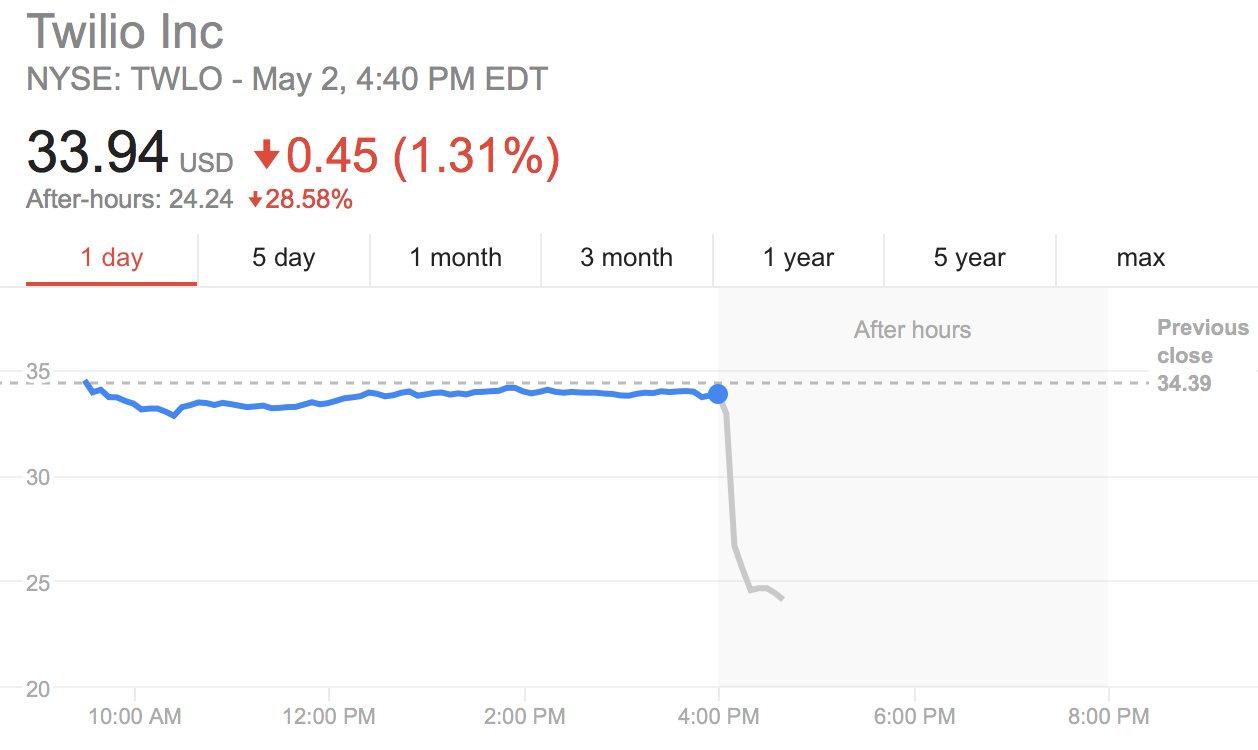

In May 2017, Twilio's stock plunged 26% after reducing its revenue forecast 2% below analyst expectations - a guidance cut and subsequent stock price reaction that nearly identically mimics Fastly's today.

Twilio after hours on May 2, 2017

The reason for that guidance cut? You guessed it: reduced spending by its largest customer, which at the time represented 12% of Twilio's revenues (incidentally the same exact exposure that Fastly has to TikTok today).

What happened following that 26% pullback is now history: Twilio's stock went on to 10x over the next three years as revenues swelled to an expected $1.6 billion this year.

Over that three year period, the value that Twilio added to its annual revenue base more than 100x'd the dollar value of the annual guidance cut that prompted its stock's overnight 26% haircut.

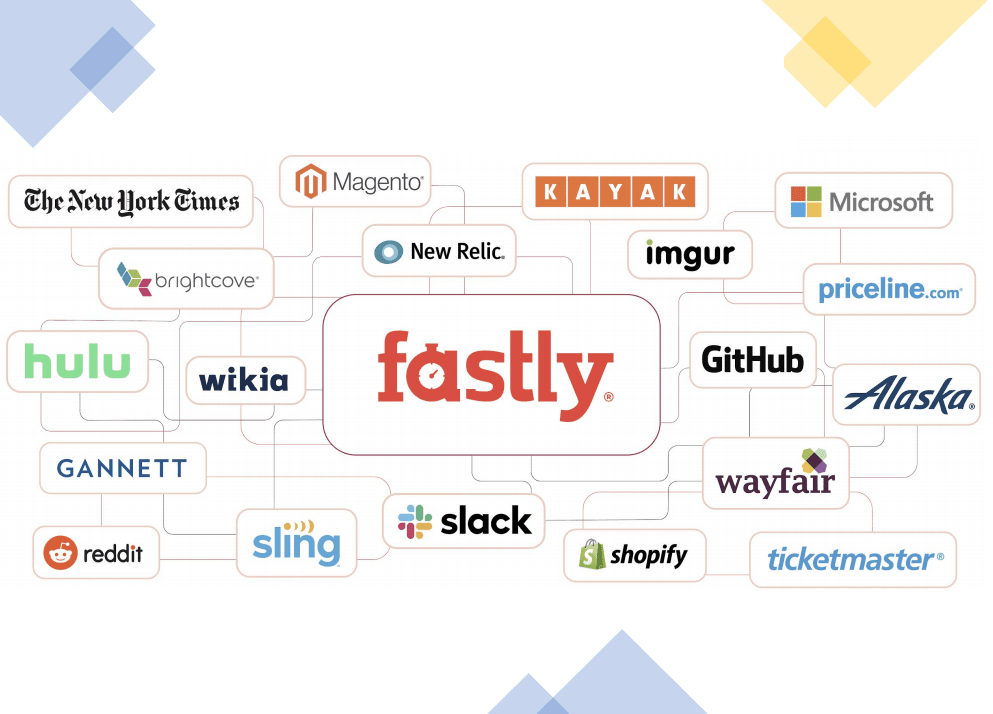

While Fastly's future is still untold, we think the company's outlook is remarkably similar to Twilio's in 2017 - not because of its trading dynamics, but because of the extremely attractive long-term growth opportunity it holds, propelled by a highly developer-centric approach to product development that was key in enabling a company of its size to count so many large technological leaders amongst its customers.

We believe Fastly and Twilio are classic case studies that point to a bigger nuance around customer concentration that often goes under-appreciated by investors.

For more on that, be sure to tune into tomorrow's Quick Thought.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.