Roku +15% on NBCU Peacock Deal

Sep 21, 2020

Peacock will finally be taking flight on Roku devices, after months of wrangling — and NBCUniversal’s TV apps will not be going dark on Roku after all. ROKU's stock is up +15% on the news and we remain bullish on this Opportunities holding.

First, Some Background:

- Peacock (NBCUniversal's Netflix competitor) launched nationwide July 15, but until now it has been unavailable on Roku as well as Amazon Fire TV. WarnerMedia’s HBO Max also remains unavailable on Roku and Fire TV over deal disagreements.

- Each side (Roku vs. NBCU) had accused the other of making unreasonable demands. NBCU wanted Peacock to be distributed on Roku without giving up a share of the advertising inventory on the service. Roku was insisting on getting some kind of compensation.

Today's News:

- Roku and NBCU reached a deal Friday afternoon that will provide access to the Peacock app on the streaming platform’s players and Roku-enabled TVs.

- In addition, the companies renewed their agreement to keep 46 NBCU broadcast and cable apps on Roku, after the media company had threatened to pull them this weekend over the dispute over Peacock.

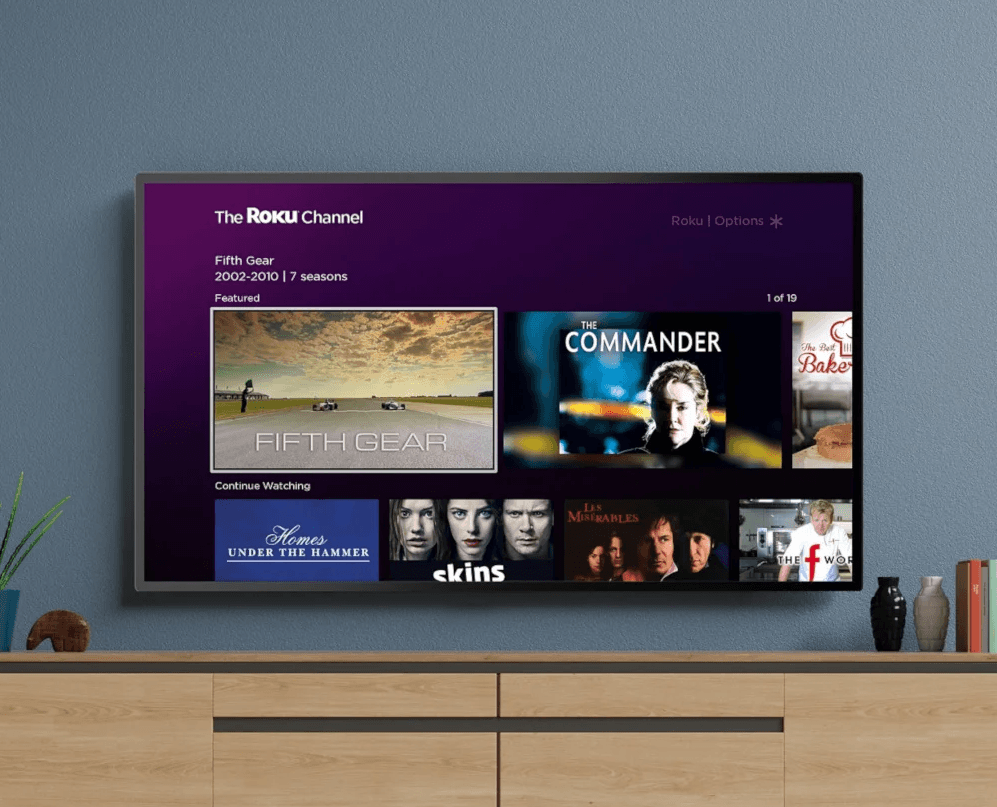

- Under the companies’ expanded pact, NBC content will be added to the free, ad-supported Roku Channel.

Why It Matters:

- We think this deal is incredibly bullish for Roku.

- While financial terms of the deal weren’t disclosed, there is definitely money changing hands, in the form of NBCU providing some kind of value to Roku. Roku itself said it has a deal for “a meaningful partnership around advertising.”

From Roku: “We are pleased to have reached an agreement with Comcast that will bring Peacock to Roku customers and maintains access to NBCU’s TV Everywhere apps. We look forward to offering these new options to consumers under an expanded, mutually beneficial relationship between our companies that includes adding NBC content to the Roku Channel and a meaningful partnership around advertising.”

That said, we think such distribution standoffs are likely to become more common as Roku and Amazon flex their big installed bases. Roku reported 43 million streaming accounts as of the end of June; Amazon says Fire TV has more than 40 million customers. Prior to Roku’s standoffs over Peacock and WarmerMedia’s HBO Max, the highest-profile case of a similar dispute was when Fox’s TV app was pulled from the platform in January 2020 — before they made peace and the app returned at the 11th hour, one day before the Super Bowl.

We continue to monitor the competitive landscape for signs that Roku's competitive moat could weaken, but for now, its immense household reach remains a distribution advantage enabling it to strike deals like this NBCU agreement.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.