PayPal Q1 2020 Earnings: The $20 billion earnings call

May 7, 2020

PayPal surged +9% after hours on Wednesday after reporting a strong long-term outlook that brought its stock price to new all-time highs.

The stock initially tumbled nearly 5% on the print as investors digested quarterly highlights from the earnings release.

However, it subsequently went on to rally almost +14% as the investor call began and management revealed some very positive data points about the business's long-term prospects.

The investor call was one of the most insightful we've been on in recent history, and offered a plethora of insights around consumer behavior that we believe will have material implications not just for PayPal, but for any company with material exposure to retail spending.

These are what’s known as “read-throughs” in the investor community. Our top takeaways and read-throughs from the call are below:

I. Takeaways for PayPal

1.) A confluence of recent developments (ranging from new user cohort adoption to accelerating contactless payment demand) have structurally improved PayPal's long-term growth thesis

- In the words of CEO Dan Schulman, "we are structurally much more bullish on our growth profile going forward…there are more tailwinds than we've seen before"

- Of the longer-term growth opportunities, management pointed to a potentially impending tipping point on omnichannel/contactless payments, which we view as an interesting moonshot opportunity

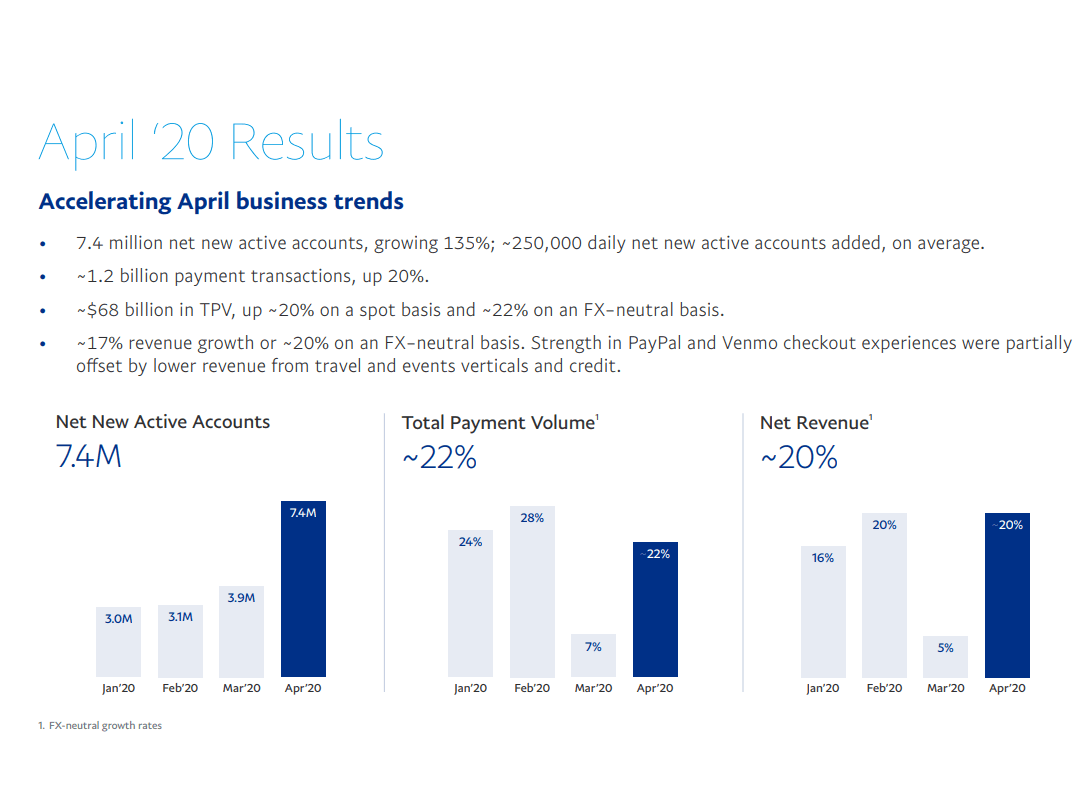

2.) The April recovery out of March weakness was far stronger than we anticipated, and was marked by "unprecedented demand" across all platforms

- PayPal's new user additions hit record highs in April, surging +140% from January and February levels

- This was coming out of the record 10 million net user additions PayPal booked in Q1, a record that the company expects to break again in Q2 with a forecasted ~15-20 million net user additions

- Payment volumes also accelerated throughout April, ultimately growing 22% despite an 80-90% decline in travel and event spending, a category that we estimate may contribute as much as ~10% to PayPal's top line

3.) Venmo has seen its platform expand dramatically across new use cases and new user cohorts, a large portion of which may prove structural

- Despite the massive recent falloff in its traditional core social use case (splitting dinner bills, cab fares, etc.), Venmo saw payment volumes grow by 48% in Q1 as numerous new use cases and user segments filled the gap and then some

- We see Venmo as on its way to becoming more of a "cross-generational platform" as increased family usage in Q1 brought in a swath of new demographics that leaned older and wealthier

- Importantly, these new user cohorts have demonstrated high initial engagement / platform adoption, a key factor for PayPal that tends to correlate strongly with its realized customer lifetime value

- Based on that initial cohort data, these recent additions could wind up representing as much as 6% of PayPal's total user base by the end of Q2

4.) Finally, some new color emerged on PayPal's "Zoom": the segment sitting within the payments giant that has been acquiring users at a triple digit pace in recent months

- PayPal has seen users on its international payments platform Xoom grow 400% since January and February of this year

- We see this growth as very "sticky" in nature as the primary use case on Xoom is foreign remittance (transfers, typically recurring, from foreign workers to their families abroad)

- Xoom was acquired by PayPal in 2015 for approximately $1 billion (just over the $800 million PayPal paid for Venmo/Braintree in 2013)

- Notably, PayPal's recently-acquired Honey platform also saw its growth surge into the triple digits, with net new actives up 180% in April vs. pre-pandemic levels

II. Read-throughs for retail stocks

1.) Expect to see online spending remain elevated at pandemic-like levels even after quarantine restrictions are lifted - a dynamic that may throw a wrench in the initial pace of the recovery in brick-and-mortar retail

- PayPal management pointed to seeing several data points that suggest that consumers may continue to prefer online channels vs. brick-and-mortar even after quarantine restrictions are lifted

- This includes PayPal’s own data from countries that have already lifted quarantine restrictions, but are still seeing consumer spending through PayPal’s assets remain highly elevated at ~2-3x pre-pandemic levels

2.) The eCommerce sector has likely gained 2-3 years of structural growth over the past 2-3 months

- A big question amongst investors in companies that have recently benefited from increased stay-at-home spending (like Amazon and Walmart) is how much of the recent growth is structural, and how much of it will go away as soon as shelter-in-place orders are lifted

- According to PayPal management, “there’s no question” that a significant portion of the recent uplift will continue to persist in normalized environments, including in categories like fashion, home goods, and electronics, where PayPal has witnessed year-over-year growth rates in excess of 50-80%

3.) As much as 33% of the recent uptick in online grocery spending may remain structurally in place post-quarantine - boding very well for investors in Amazon, Walmart, and privately-held Instacart

- Grocery spending has long been one of the final open frontiers for eCommerce, as one of the largest yet lowest-penetrated retail spending categories in the U.S.

- After many years of heavy investment in this space, sheltering-in-place may be the tipping point that finally drives wider spread adoption of online grocery purchases

- In particular, PayPal’s CFO referenced seeing data that suggested that as much as one-third of consumers may continue to purchase groceries online after quarantine measures are lifted

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.