🛡️ Recession-Proof Playbook

Mar 13, 2020

Today (March 12th) was a historic day. U.S. stocks fell 10%, one of the worst days in history, after a string of coronavirus-related updates (Europe travel ban, NBA suspension). There's a real probability of recession, which is counter-intuitively the best time to be an investor. For an active manager like us, it's go time.

Reminder how we're trading your capital: We're continuing to short the S&P 500 index to hedge your 20 Titan stocks and enable you to make some profits when the market declines.

Three things we want to ensure are clear:

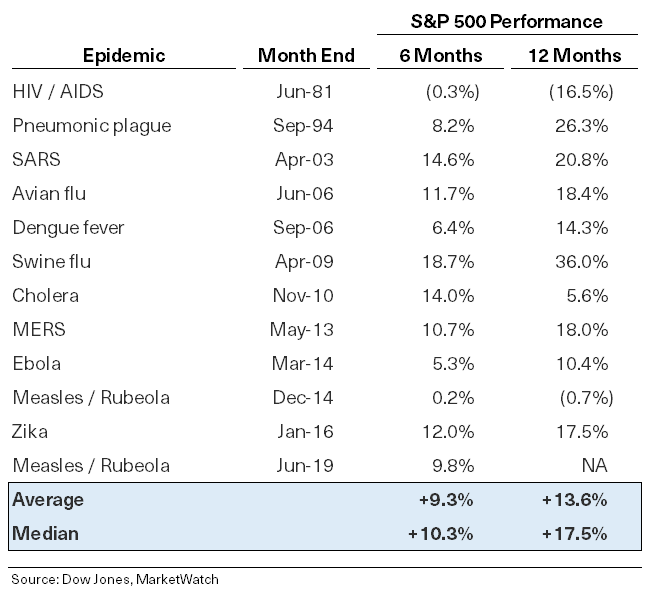

1) Panic is seeping in, and markets tend to overshoot to the downside when this happens. If prior epidemic shocks are any indication, U.S. stocks could be up 10%+ in the next year (see table below).

2) That said, we think a recession (i.e. two consecutive quarters of negative GDP growth) could arise if this "double dip" phase keeps forcing industries to suspend near-term economic activity. Not fun, but recessions are part of the economic cycle.

3) If a recession does occur, rest easy. You own 20 of the most recession-proof companies in the world, in our view. Their industry tailwinds, competitive advantages, and unit economics will survive a recession, and may even emerge stronger coming out of one.

What should you be doing? Healthwise: try not to touch your face. Financially: try not to touch your portfolio. If you have uninvested cash, you've lucked out big time: everything this year is on sale by ~25%. Even some of the best businesses in human history, like Amazon and Google. Take advantage of these major dips to get bargain-bin prices.

Your Playbook##

1) Know that Stocks Tend to Rally after Epidemics

On average, U.S. stocks have risen 9% in the 6 months following each epidemic's onset, and 14% in the 1 year following the onset. We believe this precedent is part of the reason why in our latest survey of hedge fund investors, over ~70% said they believed markets would be up 1 year from now.

It's impossible to predict whether COVID-19 will drive the same stock market trajectory as prior epidemic shocks, but there's a reason why this pattern tends to occur consistently. Epidemic shocks are always scary and unpredictable at first, but in reality tend to be one-time in nature. Don't try to time them.

2) Anticipate Future Headlines

The coronavirus outbreak will likely get worse before it gets better. As a long-term investor, you should expect more negative headlines to come:

- Your favorite restaurant chain shutting down its stores

- Your favorite getaway destination enacting a city-wide quarantine

- Your favorite sports league cancelling all games for the rest of the season

Announcements like these are usually a surprise, so they come across as dramatic, ominous, and negative. But in reality, they are net positives for the long-term outlook: for each thing that gets cancelled, more and more Americans will be shocked out of complacency and nudged to take action.

The sooner that shock occurs, the sooner lifestyles change, and the sooner that happens, the sooner America can join China (and hopefully soon, Korea) at the plateau stage of the coronavirus case count curve:

3) Do Not Try to Time the Market

Human beings are famously terrible at timing the markets. Even the world's best, most-resourced investors call it a fool's errand. Your friends probably understand this, yet still trade their own portfolios as if they are the single exception. Very unlikely.

It goes something like this: investors see a string of successive daily declines. They wait for what seems like an eternity (reality: a few weeks). Eventually, they capitulate to just make the near-term pain go away, ignoring or downplaying the long-term consequences doing so.

"I'm just getting on the sidelines until the fog clears." Anyone who says this is implicitly assuming they know where the market is going and exactly when things will bottom out. This is where most investors lose long-term compounded returns.

The markets have been brutal, we know. Long-term investors are being put to the test. But selling today means realizing losses that should turn to gains over time. It may be dark and cloudy today, but we see brighter skies ahead.

As always, let us know if you have any questions.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.