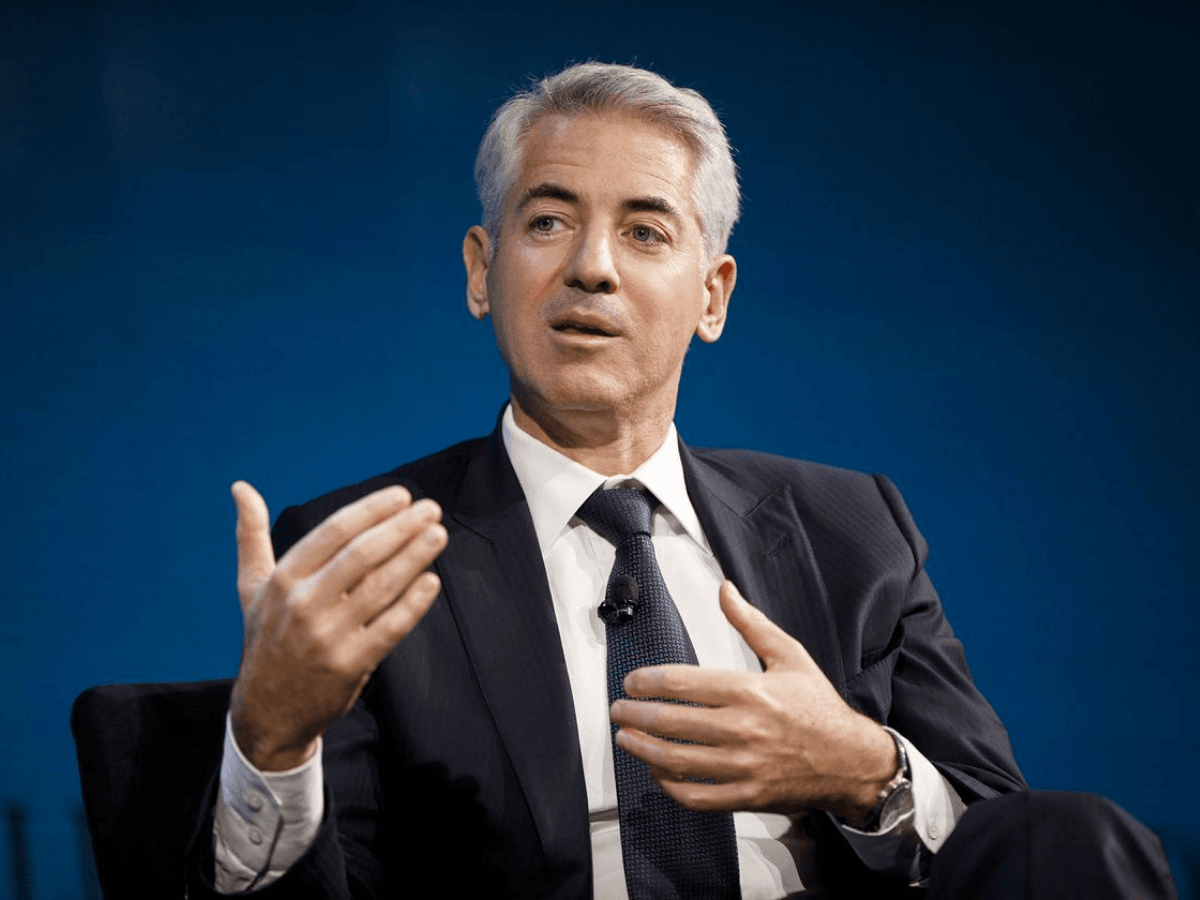

Bill Ackman now hedging against coronavirus

Mar 4, 2020

We recently initiated full hedges for all Titan clients based on their individual risk profiles (the more conservative you are, the greater the hedge).

Our Research team is constantly scouring the investing world for learnings on how other hedge funds are positioning their portfolios and how we can improve yours. Today we came across a note from legendary investor Bill Ackman of hedge fund Pershing Square Capital.

Ackman said he too is now hedging his fund's portfolio. He's basically safeguarding his holdings, which include restaurant stocks like Chipotle and hotel stocks like Hilton, against the impact of the coronavirus as it continues to threaten equity and credit markets in the U.S. and abroad.

He didn't disclose the specific hedges he's using, but we think a combination of credit index put options and/or volatility index call options is likely.

In any case, both we and other hedge funds seem to be similarly minded at this stage: remain invested in high-quality companies unlikely to be badly hurt by coronavirus, while going long hedges to protect against what we believe could be a double dip.

If you're curious, the key excerpt from Bill Ackman in Pershing Square's recent communication to investors is below:

"During the past ten days, we have taken steps to protect the portfolio from downward market volatility. We have done so because we believe that efforts to contain the coronavirus are likely to have a substantial negative impact on the U.S. and global economies, and on equity and credit markets.

*Our approach to address this concern has been to acquire large notional hedges which have asymmetric payoff characteristics; that is, the risk of loss from these hedges is limited, while their potential upside is many multiples of our capital at risk. These hedges will likely mitigate portfolio losses in severe market declines, while also somewhat reduce the portfolio’s upside potential if there is minimal economic or market impact from the virus.*

We believe this approach to hedging is preferable to that of selling our portfolio of high quality, conservatively financed companies whose long-term intrinsic value is not likely to be materially affected by coronavirus developments."

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.