Performance Scorecard

Feb 3, 2020

Given the uniqueness of our model, it's hard to make a perfect comparison between us and other platforms.

We also think it's difficult to use short-term performance metrics to gauge the quality of long-term investment strategies like ours.

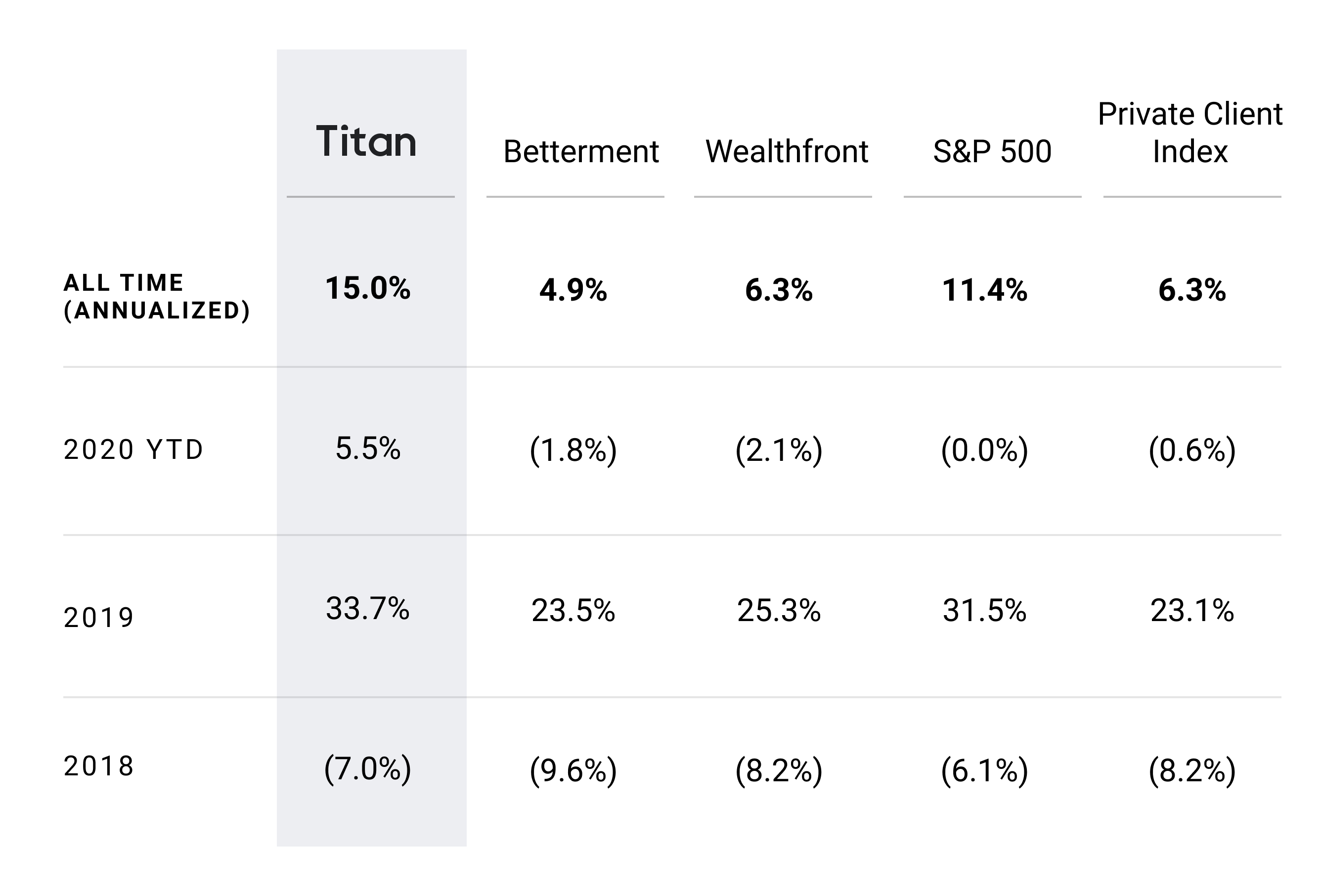

That said, below is a snapshot of how we've performed since our inception vs. several alternative platforms.

All-Time Annualized Returns (After Fees)##

Titan +15% Typical robo-advisor (like Betterment) +5-6% S&P 500 +11% Private Client Index +6%

Note: the Private Client Index is a basket of active portfolio managers invested primarily in equities. It's designed to be used by private clients and their advisors to assess the net-of-fees performance of the average investment manager.

If you have any questions, let us know and our Investor Relations team can help. Also, see full disclosures below for the nitty gritty if curious.

Disclosures Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections, are hypothetical in nature and may not reflect actual future performance. Important: All Titan performance results include the use of a personalized hedge for a hypothetical client with an “Aggressive” risk profile; clients with “Moderate” or “Conservative” risk profiles would have experienced lower returns. Please visit our Hedging page for full disclosures on our hedging process.

“Inception Date” is defined as 2/20/18 (or 2/28/18 for Betterment and PCI). 2020 YTD results are measured from 1/1/20 through 1/31/20. 2018 results are measured from Inception Date through 12/31/18. All-Time (Annualized) represents internal rate of return from Inception Date through 1/31/20.

Performance results are net of fees and include dividends and other adjustments. All performance data is strictly illustrative, may represent best estimates based on available data, and may differ from actual results. Titan results represent performance of a hypothetical account created on Titan's inception date of 2/20/18 using Titan’s investment process for an aggressive portfolio, not an actual amount. All-Time (annualized) represents internal rate of return (IRR) calculated net of fees and including dividends and other adjustments. IRR is calculated using Microsoft Excel’s XIRR function based on an illustrative starting Titan account value of $1,000 at Inception Date and its ending value on 1/31/20.

Results for the Titan portfolio as compared to the performance of Illustrative Benchmarks is for informational purposes only. “Illustrative Benchmarks” include the Betterment 90% Stock Portfolio ("Betterment"), Wealthfront Taxable Risk Score 10.0 Portfolio ("Wealthfront"), Standard & Poor’s 500 Index (the “S&P 500”), and the ARC USD Equity Risk Private Client Index ("PCI"). Titan’s investment program does not mirror that of the Illustrative Benchmarks and the volatility may be materially different from the volatility of Illustrative Benchmarks. Reference or comparison to an Illustrative Benchmark does not imply that Titan’s portfolio will be constructed in the same way as the Illustrative Benchmark or achieve returns, volatility, or other results similar to those of the Illustrative Benchmark. The S&P 500 is an unmanaged market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. S&P 500 results include the reinvestment of dividends and do not reflect transaction costs.

Performance results were prepared by Titan Invest, and have not been compiled, reviewed or audited by an independent accountant. Performance estimates are subject to future adjustment and revision. Investors should be aware that a loss of investment is possible. Account holdings are for illustrative purposes only and are not investment recommendations. Additional information, including (i) the calculation methodology; and (ii) a list showing the contribution of each holding to the portfolio’s performance during the time period will be provided upon request.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.