Disney Up +5% Ahead of Disney+ Launch

Nov 7, 2019

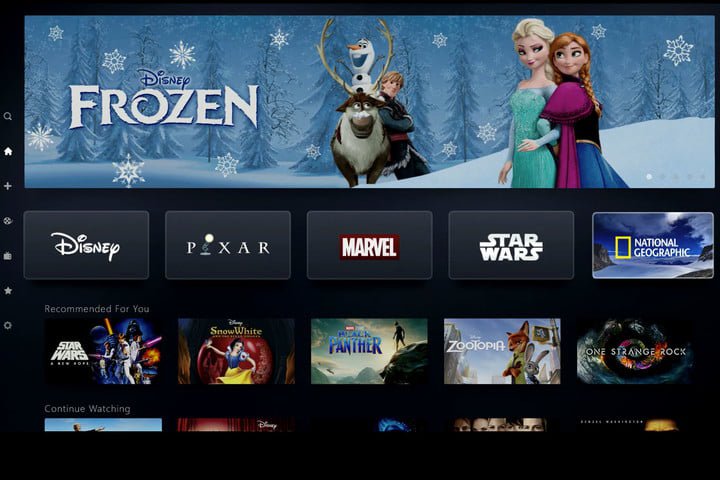

All eyes are focused on Disney ahead of its launch of Netflix-competitor Disney+. After reporting strong earnings at 4pm ET Thursday, Disney CEO came to speak on CNBC minutes after.

He revealed two operational wins, in our view:

1) Disney+ launched in beta in the Netherlands and it was being received extremely favorably. This reduces execution risk. Disney has officially proven it can build a viable version of Netflix.

2) Disney formed a partnership with Amazon to market Disney+. In this way, they are now "frenemies" - Amazon also has its own version of Netflix called Prime Video. What this shows though is that Disney wants to get scale, fast.

Key questions we'll be looking for after the rollout: - Does Disney+ cannibalize Hulu? (Disney also owns that) - How quickly will consumers adopt Disney+? - How will this affect Disney's presence on traditional TV? Namely, it's crown jewel asset ESPN.

We've been bullish on Disney+, despite skeptics citing heavy competition. Reminder of our variant perception:

"We believe [Disney+] will create enormous value for Disney by enabling today's one-time, third party revenue streams (like movie tickets) to be converted into more attractive, direct recurring payments to Disney. We believe the subscription service would also improve Disney's ability to further monetize its best-in-class portfolio by offering it direct access to valuable consumer viewing data."

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.