Now Launching: Titan for Retirement (IRAs)

Sep 24, 2019

After months and months of planning and development, we're pleased to finally announce the launch of Titan for Retirement.

It's a revolutionary reimagination of the IRA - a super important investing concept that has the capability of transforming your financial future.

To get started, simply update your Titan app, then create a new retirement account by tapping "Open a New Account" on the Account tab.

And that's all there is to it! Our IRA Concierge will handle all the heavy lifting from there.

You'll be able to transfer over an existing IRA, 401(k), or 403(b) to Titan via this method as well.

Again, no paperwork, no frustration. Just sit back, relax, and watch the magic of tax-advantaged compounding take hold.

If you're unfamiliar with IRAs, no worries, they're actually quite simple. Below is a quick 101 that will help get you up to speed on this important concept in just 2 minutes or less.

The Three Big Takeaways

- Every investor should have an IRA (individual retirement account)

- Retirement accounts like IRAs are the single most important part of your long-term financial health (the reason: tax savings)

- Titan IRAs are simple, transparent, and the best way to invest with Titan, and our IRA Concierge is here to do all the heavy lifting for you

What are IRAs?

IRA stands for “Individual Retirement Account.”

Simply put, IRAs are a special type of investment account that offer attractive tax breaks in order to help people build their savings for retirement.

Why are IRAs so important?

Two words: tax savings.

While they do have more restrictions around withdrawals and can sometimes result in penalties if you withdraw early (i.e., before retirement), IRAs allow you to reduce the amount of taxes you owe on your investments, which means more money in your pocket at retirement.

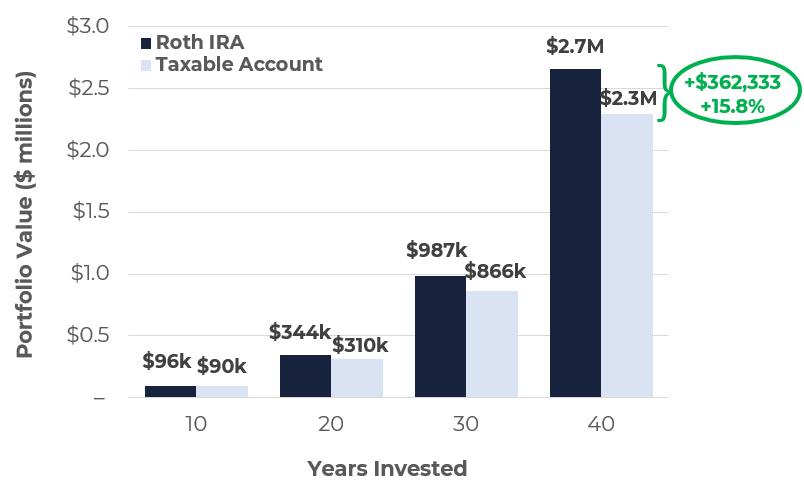

Tax-advantage investing could help you increase your retirement account's value by more than 15% by the time you retire.

If that sounds like chump change, consider this - for someone who starts soon after college and makes the $6,000 maximum contribution every year through retirement, that extra 15% could mean over $300,000 in additional value. That could be a second home, a child's college education, and then some.

Results are illustrative. Chart assumes $6,000 annual contribution, 10% compound annual growth rate (CAGR), 25% income tax rate, and 15% capital gains tax rate.

Which type of IRA should I set up?

There are two main types of IRAs:

- Traditional IRAs offer you tax breaks upfront when you fund your IRA account, but they don’t provide any tax benefits when it comes time to withdraw your savings.

- Roth IRAs work the other way around. They don’t offer any tax breaks upfront, but they do allow you to withdraw funds tax-free at retirement.

If you don't know which to choose, no worries - we cover that decision in detail in this article. In short, while there are many granular differences between Traditional and Roth IRAs, Roth IRAs are increasingly recommended by personal finance and tax experts for individuals who don't have a preference between the two.

This is mostly due to the greater flexibility Roth IRAs offer for individuals around contributions and withdrawals.

For a detailed more comparison of Traditional vs. Roth IRAs, please head here.

How does Titan’s IRA differ from others?

Great question. We designed Titan for Retirement from the ground up to be the best IRA product on the market, bar none.

Unlike other platforms, Titan doesn’t invest your IRA funds in a basket of average companies. We think your retirement savings deserve better.

Titan’s flagship investment strategy invests your money in what we like to call “long-term compounders” - businesses whose characteristics make them ideal for a long-term portfolio (like a retirement fund).

These companies tend to be high-quality ones, with high returns on capital and long secular growth runways. They tend to outperform others over the long-term because in the long run, stock market performance tends to track businesses’ underlying quality.

IRAs are similarly designed for long-term capital growth. They offer very attractive tax benefits for those who are willing to stash away funds today for a bigger nest egg at retirement.

In short: we believe IRAs are the perfect vehicle from which to capitalize on Titan’s flagship investment strategy. Titan IRAs combine tax savings with the power of long-term compounding - a match made in heaven for any long-term investor.

Feel free to check out our IRA Center for more helpful tips and FAQs. If you have any questions, we’re always available at support@titanvest.com.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.