Stocks Fall as Trade War Escalates... Again

Aug 5, 2019

You may be asking "why are stocks down?" lately. We don't see the driver being "new news." Like much of the past year, the culprit seems to be a combination of trade war tensions and global geopolitical conflicts.

Stocks Down on U.S.-China Trade Tensions... Again##

Global stock markets fell on Monday on U.S.-China trade tensions. Both countries have escalated tariff threats recently:

- Last week, President Trump announced 10% tariffs on an additional $300B of Chinese goods starting Sept. 1st

- China retaliated over the weekend by ordering state-owned enterprises to halt all purchases of agricultural goods from the U.S.

Tit for tat. It seems like every week there's a new threat, then a tentative handshake deal, followed by another threat. Market volatility has been following suit.

The media added their usual dose of superlatives, of course. "Global stocks were in disarray after China escalated the trade war with the US by devaluing the yuan to fall below its 7-to-1 ratio with the US dollar for the first time in a decade."

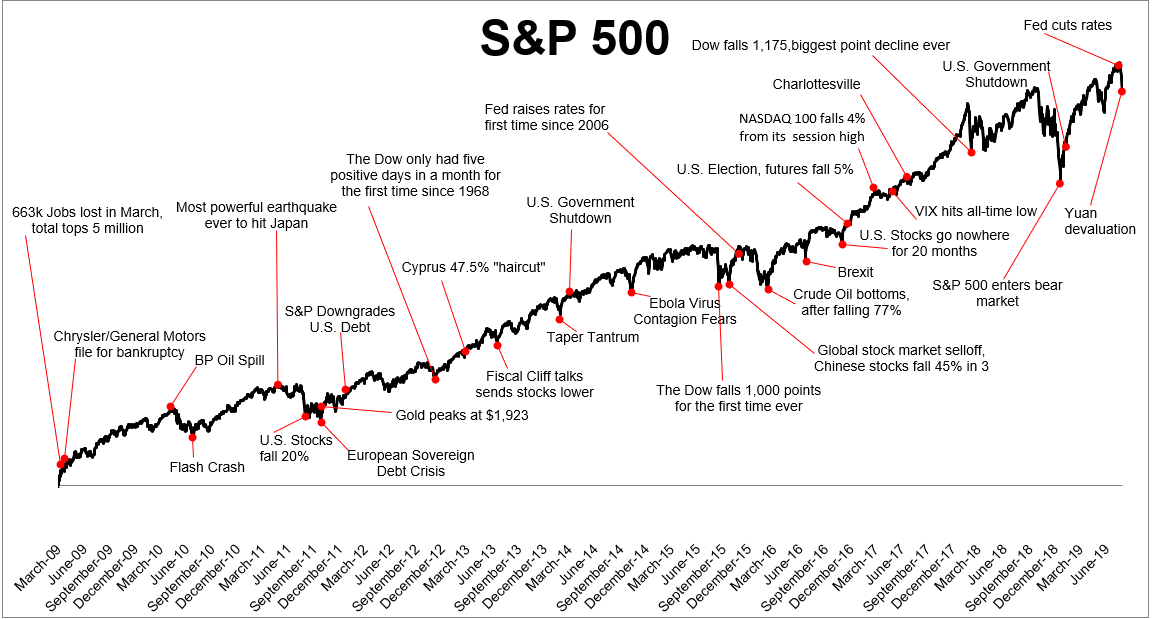

Zoom Out##

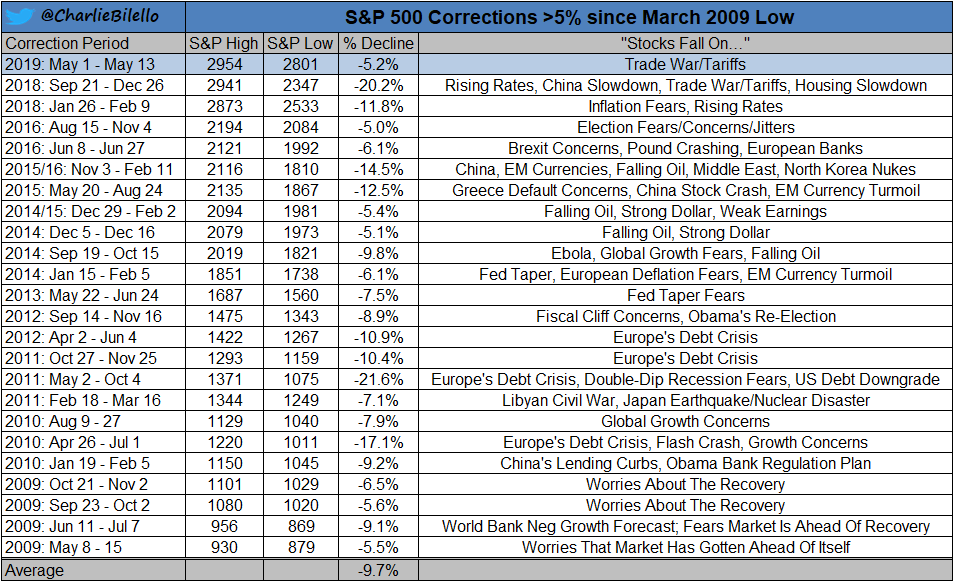

Zooming out, this is the 25th correction of a >5% decline that the market has seen since the lows in March 2009. There have been plenty of reasons to worry over the last 10 years. We posted the below chart back in May and it's still relevant:

All of these corrections seemed like the end of the world at the time. People panicked, sold their stocks, and moved to cash or bonds.

During the 25 times you may have worried about your stocks being down >5% in the past 10 years, here's how a patient long-term investor would have fared:

Quick Reminder on Tariffs##

We've talked at length about the Titan composite's minimal exposure to U.S.-China tariffs given the asset-light nature of the companies.

Apple is the only Titan company affected in a material way given it imports a great deal of its components from China. Tariffs would increase those import costs and decrease profits, all else equal. We estimate a 4-11% hit to earnings if Apple absorbed the full impact without increasing its iPhone prices at all, which we think is unlikely.

Instead of rehashing our thoughts on tariffs, let's reflect on the attractiveness of U.S. stocks today broadly.

Attractiveness of U.S. Stocks##

As we explained in our recent video on Paradigm Shifts, the S&P 500 is offering a ~6% earnings yield today (the reciprocal of the 17x P/E ratio -- it's what a stockholder is effectively being paid to own U.S. stocks).

Compared to the ~1.9% "risk-free" yield on 10-year U.S. Treasury bonds, we think U.S. stocks offer attractive returns today -- particularly the high-quality compounders that comprise the Titan composite.

Not only that, but the S&P's dividend yield is roughly 1.9%. That's higher than the yield on "risk-free" 10-year U.S. Treasury Bond (!). This means U.S. companies are paying you more in dividends than the risk-free rate, plus those companies could likely grow earnings to deliver even higher returns. Historically when this has happened, the market has proceeded to power materially higher in subsequent years.

Very simply: we believe this correction is yet another opportunity for long-term investors to arbitrage these short-term macro concerns and scoop up high-quality businesses on sale.

Our Advice##

If you're pulling out of stocks because you're scared about a downturn, you may want to zoom out and see the bigger picture. The typical leading indicators of a recession (e.g., sharply slowing GDP growth, runaway inflation, uptick in unemployment rate) don't appear to be flashing red right now. We remain constructive on the U.S. economy and market.

Historically, times like these have been fruitful for the long-term investor who actually adds more capital to her portfolio, rather than withdrawing. Lower market prices (like we're seeing today) without a deterioration in future earnings growth prospects (which we don't believe we've seen) is usually a great setup for forward returns.

Patience is not just a virtue in investing. It's how the best long-term investors take advantage of the emotional traders unwillingly to look "wrong" in the short term.

Buy when others are fearful.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.