Upcoming Prime Day Sparks Deal Frenzy

Jun 26, 2019

Prime Day: The Details##

Amazon is hosting its Prime Day shopping event across two days this year, July 15 and 16. You'll see over 1M deals, including price discounts on televisions, Amazon devices, and a lot more.

With more than 100 million Prime members, Prime Day has become a major annual shopping event. It's no surprise that competing retailers are looking to take advantage of the Black Friday-like frenzy.

For example, eBay will launch a "Crash Sale" (throwing shade at Amazon's site crash last year) on July 15. Target is launching its "Target Deal Days" on July 15-16, highlighting that the sale doesn't require a membership.

We actually think that competing against Amazon Prime on Prime Day without a strong membership program is a losing battle, as we explain below.

How Amazon Prime Remains the Secret Weapon##

Over 50% of U.S. households subscribe to the all-you-can-eat membership program which includes free 1-2 day shipping and loads of other perks. It's literally a household name.

Prime allows Amazon to offer steeper discounts and more compelling value to consumers than pretty much any competitor can offer.

As Amazon grows, its ability to offer steeper discounts gets even bigger ("economies of scale").

Why? Because it's a subscription business model with high retention, which means predictable, recurring revenue. That means very high "lifetime value" (LTV) -- the value Amazon will get from a customer for the lifetime that they subscribe to Prime.

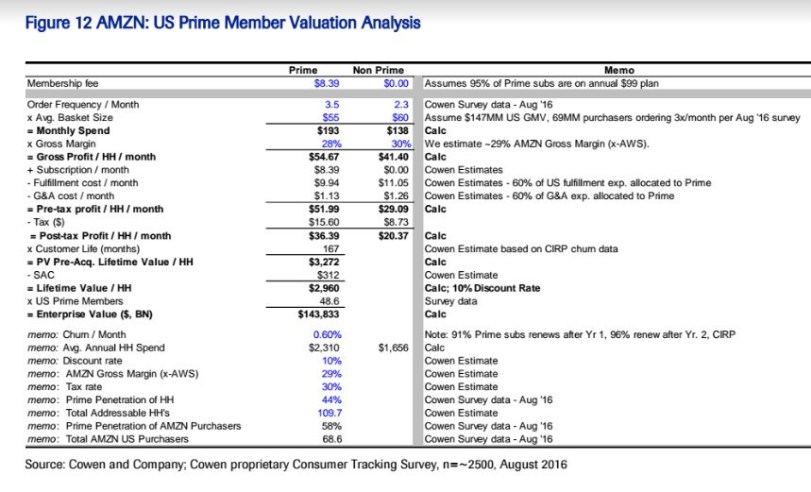

One Amazon analyst penciled out the Prime LTV as follows (full link here):

As of August 2016, the lifetime value of a Prime customer was estimated to be nearly $3,000.

This LTV figure has likely grown substantially since then. Over the past three years, the product selection on Amazon.com has grown, so customers are more likely to find what they want and stay Prime members for longer. Also, shipping times have fallen from 2-day to 1-day on many items, increasing convenience and probably retention too.

But let's assume it's still $3,000 for conservatism. This fat LTV gives Amazon a huge cushion vs. other retailers without membership programs. It means Amazon can afford to push the pricing envelope and offer deeper discounts to Prime members on Prime day.

Why? It can make up the foregone profits from any huge Prime Day discounts over the many years it will keep a Prime customer. Not to mention the ability to upsell and cross-sell other services like Amazon Fresh.

Takeaway: The Everything Store is Still Unmatched##

Amazon Prime's unmatched LTV creates a conundrum for all retailers -- especially those without membership programs.

Brands will do their best to host sales of their own in anticipation of Prime Day. It's basically their only option, and it's not a bad idea. About 72% of shoppers will go beyond Amazon to comparison shop, according to a Adlucent survey, and some are bound to make a few purchases on eBay, Target, etc.

But in the grand scheme of things, we think most consumers will still close the deal at the Everything Store.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.