What Investors Don't Get about Google

Apr 30, 2019

Q1 Headwinds Drive GOOG Down Sharply##

Alphabet's stock fell sharply on Q1 results, due primarily to ad revenue growing "only" +17% (vs. expectations of +19%).

Investors seemed shocked by the slowdown. Management cited negative impacts from currency fluctuations, timing of ad product changes, and a stagnating global smartphone market. But investors didn't seem to buy it.

How does Q1 impact the long-term thesis for Google's stock, and is the stock price undervaluing that thesis?

Our take:

- Google is deliberately building its business slowly, bypassing revenue it could be making so it can drive more viewers

- The near-term ad sales slowdown was self-inflicted (e.g. changes at YouTube's recommendation engine), not a structural problem for GOOG

- The "slowing growth" narrative has created a dislocation in the stock, which is now dramatically undervaluing the company for long-term investors

What Investors Are Missing: Slow and Steady is Better##

Here's what investors are thinking:

- Ad revenue grew +17% in Q1, the first time Google has grown less than 20% since 1Q 2015 and lower than investors' +19% estimates

- Increasing ad competition (AMZN, FB) could be weakening Google's moat and forcing it into a "new normal" of slower growth

We disagree -- here's our take:

- Much of the growth slowdown in Q1 was self-inflicted (e.g. changes to YouTube's recommendation engine)

- Competitors like Amazon probably did play a role, but not to the extent many investors seem to think

- The hardware team at Google also had some difficulties given a stagnating global smartphone market

- Management's transparency around YouTube could definitely improve -- we hope to see changes here soon

Putting aside Q1 results, Google is deliberately building its business slowly, bypassing revenue it could be making so it can drive more scale first.

It could be making much more money off of YouTube, for example, but is optimizing for viewership growth. Yet the market seems to be penalizing Google for the recent ad slowdown, plus bets that are costing money today but could pay off in the future.

Which brings us to valuation.

The Right Way to Value GOOG##

In 2017, one of our favorite investors, Bill Nygren who runs the successful Oakmark fund, did an analysis on what Google's true valuation was.

Today, GOOG's headline P/E ratio is 25x. It would be very easy to stop right there and say, yes, Alphabet is a great company but everyone knows it, hence it trades at a premium.

We think that take is wrong.

This headline P/E ratio is based on "GAAP earnings." GAAP earnings are a metric that makes life easier to compare stocks like Google, Coca-Cola, and McDonalds on an apples-to-apples basis. Or so people think.

The problem is, traditional GAAP accounting does not accurately reflect a modern software/services company like Alphabet. It misses a number of critical adjustments and unfairly penalizes Alphabet for the deliberate strategic decisions it's made to maximize long-term shareholder value. Not to mention its diverse businesses.

For example, advertising is an incredibly high margin business, while YouTube is likely closer to breakeven and Waymo is losing billions as it has no revenues currently. What's the right P/E ratio for GOOG when you lump all its complex businesses together? Most people don't do the math.

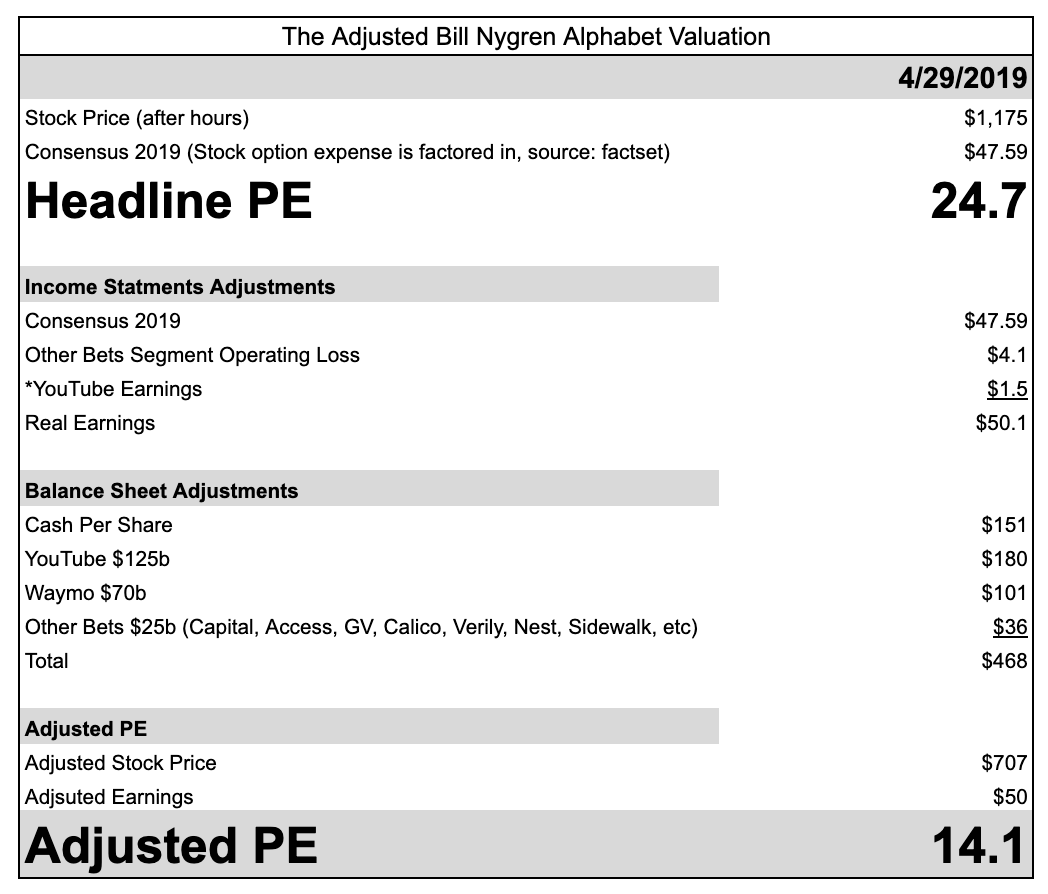

Here's a crack at the true valuation math for GOOG:

Thanks to our friends over at HardCore Value, a financial blog, who did this analysis to more accurately reflect the accounting for a modern company like Alphabet. They ascribe $125B value to YouTube and $70B value to Waymo (below the estimated $160B-220B and $75B-110B valuations from firms like Morgan Stanley and Evercore), plus some other adjustments.

Putting It All Together: GOOG Trades at ~14x P/E##

Based on the analysis above, we believe GOOG is actually valued at only ~14x 2019 P/E once you adjust for various factors that the market is missing. The S&P 500 is valued at ~17x 2019 P/E today.

That makes GOOG -- one of (if not THE) best businesses in the world -- cheaper than the average U.S. company.

We'll leave you with one of Bill Nygren's famous remarks on Google:

"I've read a lot of arguments about the multiple the Google business deserves, but not once has it been below-market […until now]."

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.