Uber/Lyft S-1 Comparison: A Tale of Five Charts

Apr 12, 2019

On Thursday afternoon, transportation giant Uber finally filed to go public after months of market speculation and rumors. Here are our first takeaways after combing through its 3,000+ page S1.

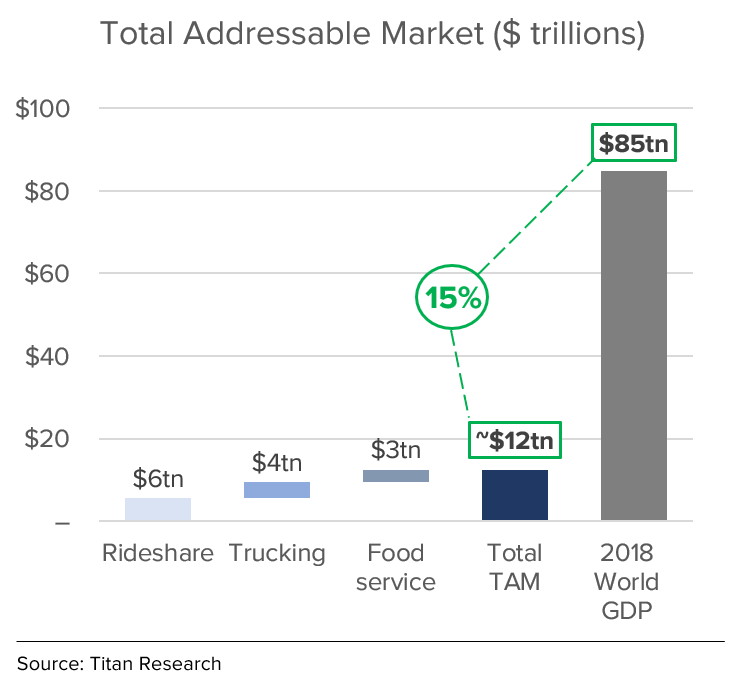

Its TAM figures should probably be ignored.##

- Total addressable market (“TAM”) is one of the first things investors tend to focus on when assessing high-growth, long-tail businesses like Uber

- Across its three primary target markets (rideshare, trucking, and food service), the total implied value of the market opportunity that Uber is pitching investors represents $12 trillion – or nearly 15% of the entire world’s GDP in aggregate

While historical growth has been very strong, recent quarters tell a different story, with sequential growth turning negative in the last quarter of 2018.##

- This is especially notable since the fourth quarter is known to be a seasonally strong quarter for ridesharing businesses (holiday and business demand)

- The third quarter is conversely a seasonally weak quarter (peak vacation season in many cities)

- This combination of dynamics should make posting Q4 growth a very low bar to hit, which Uber didn't

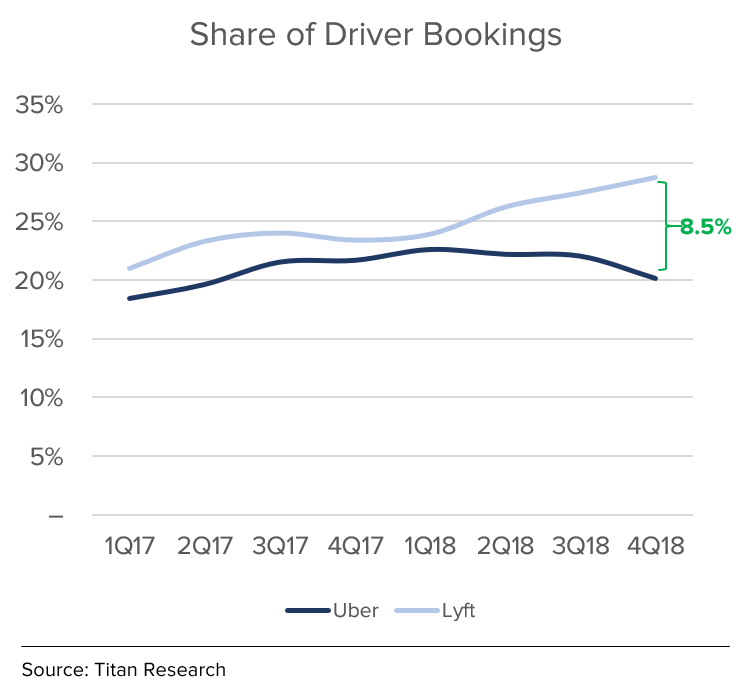

We believe this negative trend is largely attributable to pressure on Uber’s take rate.##

- Uber has consistently undercut Lyft on the portion of driver bookings it keeps, known as “take rate"

- That delta has only increased in recent quarters as Uber and Lyft took two different approaches in shoring up their books pre-IPO

- We believe Lyft was more focused on improving profit metrics, while Uber was more focused on managing supply/demand, resulting in the two divergent take rate trajectories we’ve observed:

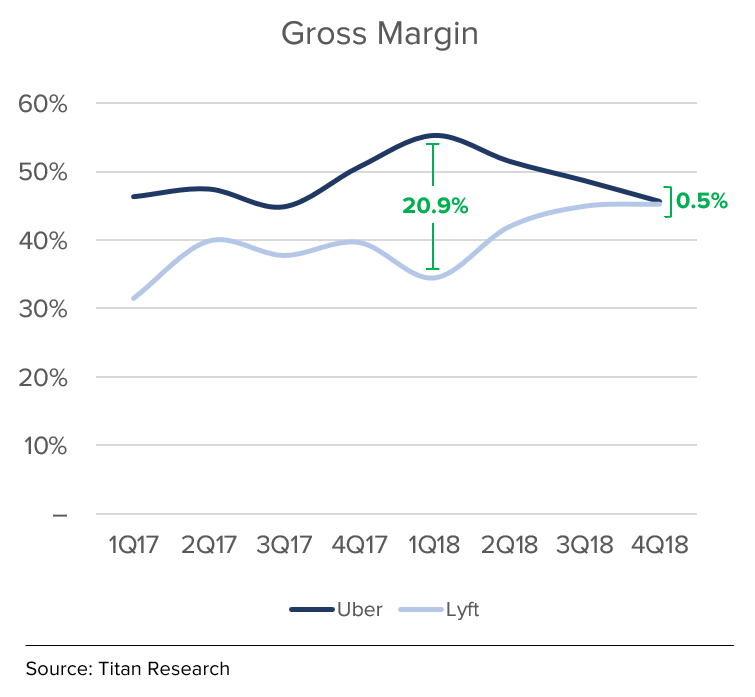

This downward trend should negatively impact gross margins, but because of different reporting practices, Uber’s gross margins actually appear higher.##

- This is just one of the many frustrating inconsistencies in reporting standards that we encountered as we combed through the Uber’s S1

- Slight differences in reporting standards (as well as poor disclosures on many key financial metrics) make it difficult to properly model the business and make key comparisons we believe investors should be focused on

Despite being 5x the size of Lyft, Uber’s profit trajectory does not appear to have as significant a lead on Lyft as we would expect.##

- Over the last 8 quarters, Lyft has steadily made inroads on closing the margin gap between itself and Uber

- We believe Uber’s focus on other, non-ridesharing verticals is the major contributor to this dynamic

- Its take rate on its food delivery business, for instance, is less than half its take in core ridesharing markets

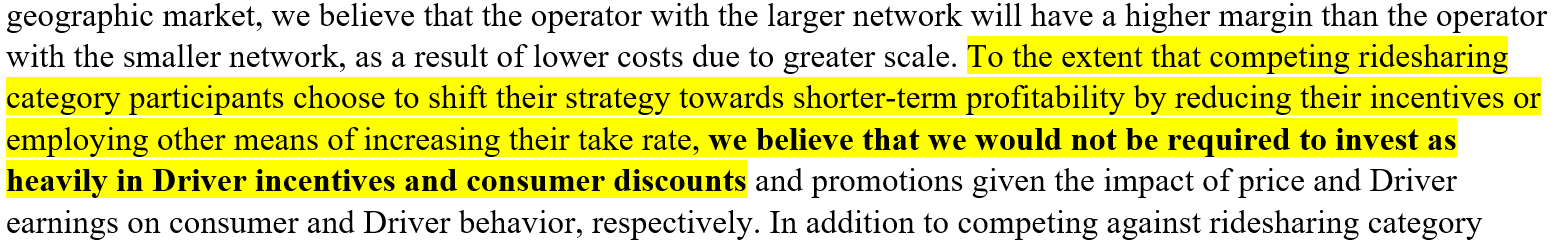

Finally, it has something important to say to Lyft:##

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.