Deep Dive on Facebook

Feb 5, 2019

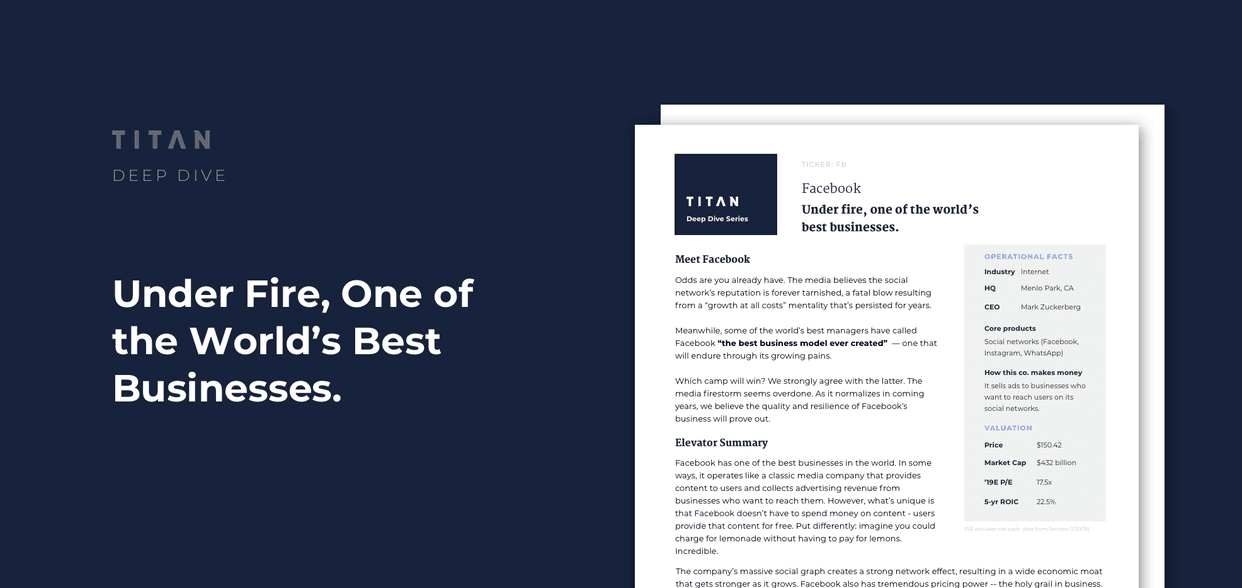

Meet Facebook##

- The media seems to believe the social network’s reputation is forever tarnished, a fatal blow resulting from a “growth at all costs” mentality that’s persisted for years.

- Meanwhile, some of the world’s best managers have called Facebook “the best business model ever created” — one that will endure through its growing pains.

- Which camp will win? We strongly agree with the latter. The media firestorm seems overdone. As it normalizes in coming years, we believe the quality and resilience of Facebook’s business will prove out.

Elevator Summary##

- Facebook has one of the best business models in the world. In some ways, it operates like a classic media company that provides content to users and collects advertising revenue from businesses who want to reach them.

- What’s unique is that Facebook doesn’t have to spend money on content - users provide that content for free. Put differently: imagine you could charge for lemonade without having to pay for lemons. Incredible.

- We believe the company has strong network effects and pricing power, resulting in a wide economic moat that gets stronger as it grows and helps Facebook fend off competitors.

- Headlines misunderstand that Facebook is still just getting started. We think it only has 5% market share of potential sales & marketing dollars, plus huge revenue potential from Instagram and WhatsApp.

Our Contrarian View##

- Sentiment seems extremely negative on Facebook today, as security and privacy issues have plagued the company.

We think most people forget that Facebook has some of the best infrastructure engineers in the world to fix its security issues. We believe they can and will.

We believe the media assault on Facebook has created a rare opportunity for investors to join the journey of one of the best businesses ever, at a discount. Near its all-time low valuation, the stock appears attractively valued for long-term investors.

Read the Deep Dive##

You can read the full Deep Dive, along with our videos and podcasts, by joining Titan today.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.